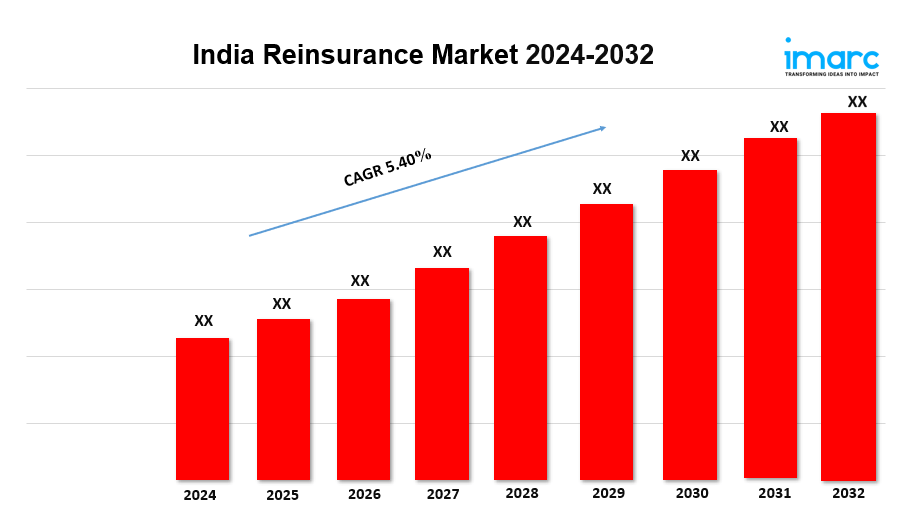

India Reinsurance Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 5.40% (2024-2032)

The India reinsurance market is expanding due to regulatory reforms, increasing insurance penetration, and rising demand for risk management. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 5.40% from 2024 to 2032.

India Reinsurance Market Trends and Drivers:

The growth of the India reinsurance market is driven by a booming insurance sector and rising awareness of risk management. Increasing demand for insurance coverage in areas like property, health, and agriculture is fueling the need for reinsurance, as insurers rely on it to manage large claims and catastrophic risks. India’s vulnerability to natural disasters such as floods, cyclones, and earthquakes further emphasizes the importance of reinsurance.

Regulatory changes from the Insurance Regulatory and Development Authority of India (IRDAI), including mandatory reinsurance cessions and market liberalization for foreign reinsurers, are boosting capacity and competition. Additionally, the market is witnessing a shift toward specialized and customized reinsurance solutions as insurers face complex risks, such as cyber security, climate change, and health pandemics. Reinsurers are creating tailored products to meet these emerging challenges.

The adoption of digital technologies and data analytics is transforming the reinsurance landscape, enabling precise risk assessment and pricing, contributing to market growth. Moreover, the increasing participation of global reinsurers is driving innovation, introducing international best practices, and enhancing the efficiency and resilience of India’s reinsurance sector, positioning the market for strong growth in the coming years.

Request for a sample copy of this report: https://www.imarcgroup.com/india-reinsurance-market/requestsample

India Reinsurance Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

- Facultative Reinsurance

- Treaty Reinsurance

- Proportional Reinsurance

- Non-proportional Reinsurance

Breakup by Mode:

- Online

- Offline

Breakup by Distribution Channel:

- Direct Writing

- Broker

Breakup by Application:

- Property and Casualty Reinsurance

- Life and Health Reinsurance

- Disease Insurance

- Medical Insurance

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=21371&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145