India Foreign Exchange Market Overview

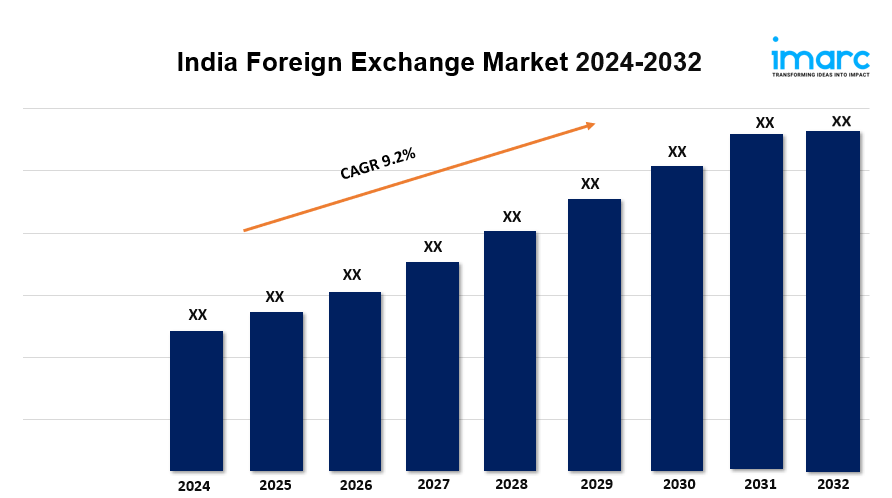

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 9.2% (2024-2032)

The India foreign exchange market facilitates currency trading, ensuring liquidity, price discovery, and risk management for international transactions. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 9.2% from 2024 to 2032.

India Foreign Exchange Market Trends and Drivers:

The India foreign exchange market is rapidly expanding due to a number of linked causes. The market is primarily driven by fast economic growth, increased international commerce, and foreign investment. Besides this, with India’s economy becoming more integrated into the world economy, there is a greater need for foreign currency in industries like manufacturing, exports, and IT services.

Additionally, government policies aimed at liberalizing the economy, coupled with reforms in the banking and financial sectors, are fostering a favorable environment for forex trading. In line with these factors, the rise in non-resident Indian (NRI) remittances and foreign direct investments (FDI) further contribute to the expansion of the India foreign exchange market, as both inflows and outflows necessitate active foreign exchange management.

Trends in the India foreign exchange market highlight the growing adoption of digital trading platforms and automated forex systems. These innovations are simplifying access to currency markets, allowing both individual and institutional traders to engage effectively. Moreover, the Reserve Bank of India’s (RBI) regulatory oversight and initiatives to promote financial inclusion are bolstering market confidence.

There is also an increasing preference for hedging instruments like forward contracts and options, which help businesses manage currency risk effectively. As global market volatility continues, this trend is expected to strengthen, with greater participation from corporate and retail sectors. Overall, the combination of regulatory support, technological advancements, and rising global trade is driving the growth and sophistication of the market. Apart from this, the convergence of these factors is expected to propel the expansion of the India foreign exchange market in the coming years.

Request for a sample copy of this report: https://www.imarcgroup.com/india-foreign-exchange-market/requestsample

India Foreign Exchange Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Counterparty:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

Breakup by Type:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Breakup by Region:

- South India

- North India

- West & Central India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9345&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145