India Private Equity Market Overview

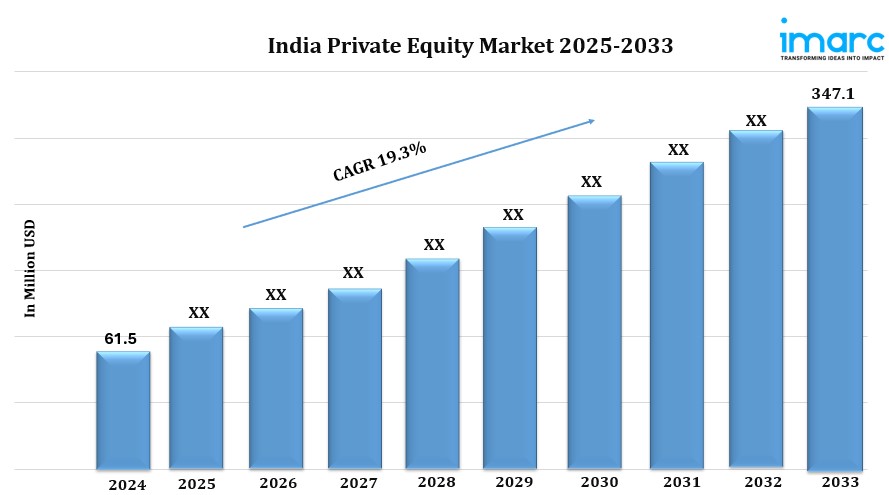

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 19.3% (2025-2033)

Market Size in 2024: USD 61.5 Million

Market Size in 2033: USD 347.1 Million

The India private equity market is growing rapidly, driven by robust investment activity, digital transformation, and favorable economic conditions. According to the latest report by IMARC Group, the market size reached USD 61.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 347.1 Million by 2033, exhibiting a growth rate (CAGR) of 19.3% during 2025-2033.

India Private Equity Market Trends and Drivers:

The India private equity market is witnessing robust growth, fueled by fast economic expansion, a thriving startup ecosystem, and a rising number of high-net-worth individuals (HNWIs). Private equity (PE) firms are capitalizing on abundant investment opportunities, particularly in high-growth sectors such as technology, e-commerce, fintech, and healthcare.

The market’s growth is further supported by the increasing focus on digital transformation across industries, bolstered by government initiatives like Digital India and Make in India. Additionally, a young, dynamic consumer base and an expanding middle class are driving demand in consumer goods, retail, and financial services sectors where PE firms identify significant potential for development.

Key trends shaping the market include a growing interest in venture capital and early-stage investments, especially in technology-driven startups. PE firms are also aligning with environmental, social, and governance (ESG) principles, focusing on sustainable and impact-driven investments. This strategic shift is influenced by global trends and domestic regulatory frameworks promoting responsible investing.

An emerging trend in the market is the rise of secondary transactions, where PE firms purchase stakes from other investors, enhancing liquidity in the maturing market. Additionally, sector consolidation in areas like healthcare and logistics is providing avenues for PE firms to generate value through mergers and acquisitions.

With strong economic fundamentals and evolving investor preferences, India’s private equity market is poised for sustained growth, establishing itself as a key global and domestic investment hub in the years to come.

Request for a sample copy of this report: https://www.imarcgroup.com/india-private-equity-market/requestsample

India Private Equity Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Fund Type:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Breakup by Region:

- South India

- North India

- West and Central India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9949&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145