India Fintech Market Overview

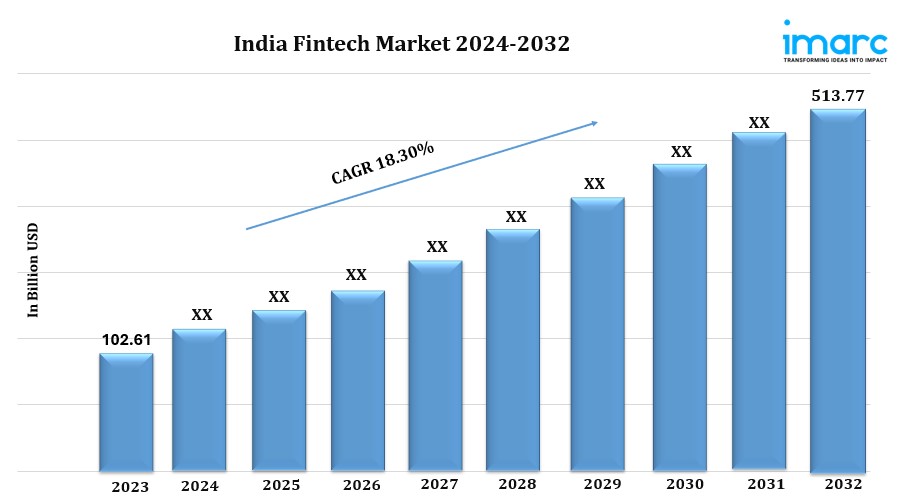

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 18.30% (2024-2032)

Market Size in 2023: USD 102.61 Billion

Market Size in 2032: USD 513.77 Billion

The India fintech market is rapidly growing, driven by digital payments, lending platforms, and increasing financial inclusion initiatives. According to the latest report by IMARC Group, the market size reached USD 102.61 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 513.77 Billion by 2032, exhibiting a growth rate (CAGR) of 18.30% during 2024-2032.

India Fintech Market Trends and Drivers:

The India fintech market is experiencing robust growth, fueled by increasing digitalization, widespread smartphone adoption, and supportive government policies. The introduction of the Unified Payments Interface (UPI) has transformed financial transactions, positioning India as a global leader in digital payments.

Government initiatives like Digital India and Pradhan Mantri Jan Dhan Yojana have laid a strong foundation for financial inclusion, enabling fintech companies to extend their services to rural and underserved regions. The surge in e-commerce and the preference for contactless payments during the COVID-19 pandemic have further driven the adoption of mobile wallets, digital lending platforms, and investment apps.

Technological advancements are propelling the fintech sector, with innovations in artificial intelligence (AI), machine learning (ML), and blockchain enhancing efficiency, security, and personalized financial solutions. Additionally, the emergence of neobanks is reshaping traditional banking by delivering seamless, user-friendly digital services.

A favorable regulatory framework, supported by the Reserve Bank of India (RBI), is fostering innovation while safeguarding consumer interests. As digital financial solutions gain traction and the startup ecosystem flourishes, the India fintech market is poised for sustained growth, offering cutting-edge products tailored to the diverse needs of its population.

Request for a sample copy of this report: https://www.imarcgroup.com/india-fintech-market/requestsample

India Fintech Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Deployment Mode:

- On-Premises

- Cloud-Based

Breakup by Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Breakup by Application:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Breakup by End User:

- Banking

- Insurance

- Securities

- Others

Breakup by Region:

- North India

- South India

- West and Central India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=10442&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145